Financial Disclosure

As a 501(c)(3) tax-exempt organization, we are required to annually file an exempt organization information return Form 990, Return of Organization Exempt from Income Tax. The club believes in providing full transparency to its club members. The club’s annual filings are available for public disclosure and can be reviewed by visiting the webpage Foundation Center. Input our organization’s name, state, zip code and fiscal year you wish to review. (Do not need to input EIN).

We know that travel soccer is expensive. As a community club, we take seriously our obligation to be responsible stewards of the money you pay for the program. We have held fees flat year over year (including paying for 50% for Parisi Speed and Agility), even while we continue to improve the program. We believe our program provides great value, given that other club programs may charge up to $2000 or more and not provide the same level of offerings to their members.

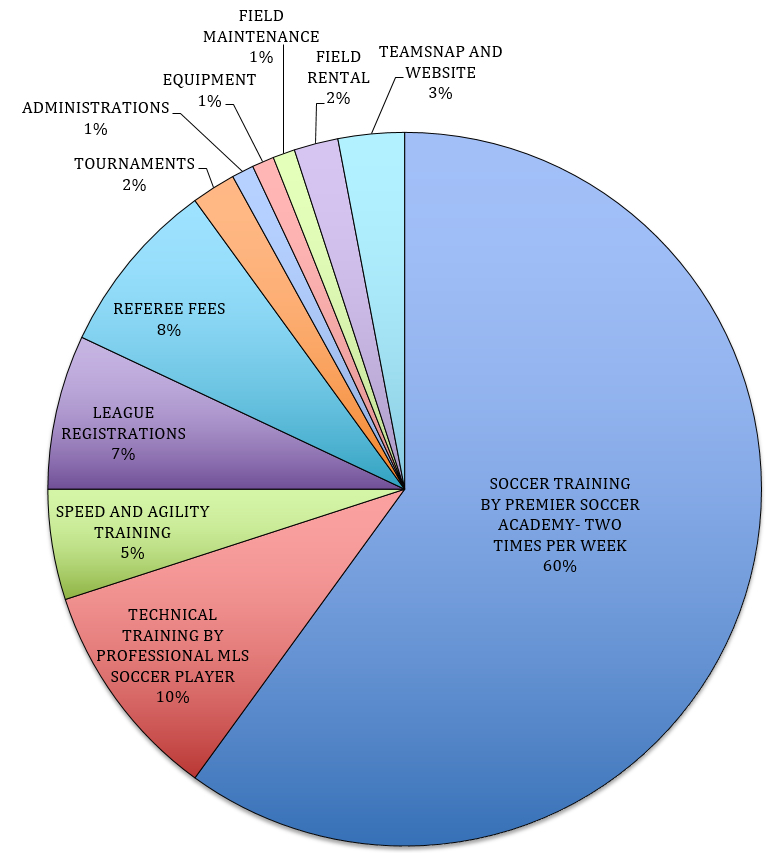

We believe you should know where your money goes. This chart provides an overview for 2018/19:

We are able to keeps costs constrained because much of the Club’s administration is run by volunteers. We will need your help this coming season. Please contact paramusunitedsoccer@gmail.com to volunteer your services.